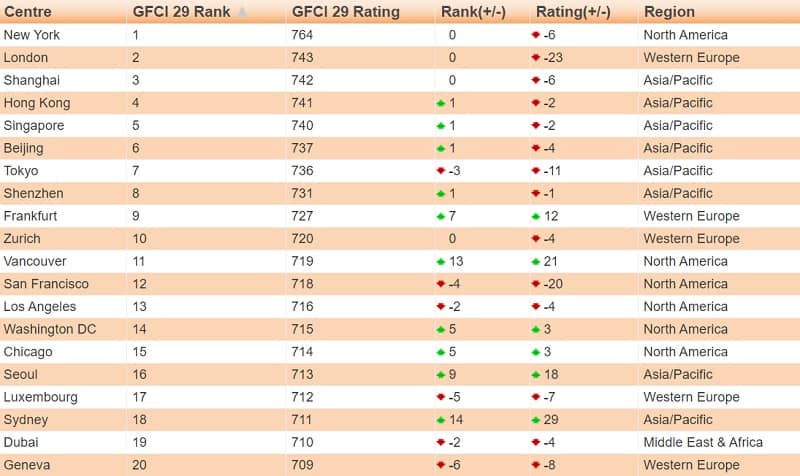

New York, London, and Shanghai maintain the top 3 spots followed by Hong Kong, Singapore, Beijing, Tokyo, and Shenzhen

The world’s financial systems are starting to stabilise with vaccines being rolled out on a daily basis and things are going back to normal. The pandemic had a significant impact on financial markets and this is reflected in the latest Global Financial Centres Index (GFCI) where Asian cities dominated the rankings.

Of the top 10 financial centres, only Frankfurt’s rating improved by 12 points, while the other hubs dipped in ratings. Overall, the index scores are lower compared to 2019, but the average scores have only decreased by 0.55% which shows that people are beginning to put more trust in the financial systems.

New York has taken the lead again, but there are a total of 6 Asian cities on the list. London stayed firm in 2nd place despite the Brexit and pandemic double whammy, but Shanghai seems to be catching up. Shanghai moved up to 3rd place and its ratings suggest that the city has been improving its financial systems as it has outperformed many of its competitors.

Shanghai has an “omni-category financial market system” that includes stocks, bonds, futures, currency, foreign exchange, gold, insurance, and trusts. Its improved ratings imply that it is quickly become one of the most stable and trusted financial systems not just in Asia, but in the entire world.

Tokyo, on the other hand, dropped from 4th place to 7th in this year’s GFCI. A London based consultancy said that they believed Shanghai would easily overtake Tokyo since the country surpassed Japan and became the second-largest economy in the world in 2010. Owing to the tensions between the United States and China, the Chinese government has taken steps to liberalise their financial markets, which explains why they moved up in the rankings.

While there’s no clear reason as to why Tokyo has moved down in the rankings, the GFCI 29 states that it could be because of central banks taking more control during COVID-19. Hong Kong, which ranked 4th on this year’s GFCI, has a “free system of economy and law” which is the major reason why it’s attractive to so many investors. Singapore and Beijing ranked 5th and 6th, respectively. Hong Kong, Singapore, and Beijing all moved one rank up and managed to overtake Tokyo.

In a press release, Michael Mainelli, the executive chairman of a London based commercial think-tank called Z/Yen, stated that the scores in the GFCI show “a welter of instability in international trade, politics and economics, not least large-scale interventions by central banks and questions about the future treatment of commercial banks, insurers, and payment providers.”

China seems to have emerged as the best financial system in the Asian hub. China’s government has been promoting projects that will help the country regain its position as the dominant financial centre in all of Asia. They initiated a 3-year development plan to encourage fintech innovation, which will attract even more investors. It would be no exaggeration to say that Shanghai could overtake London in a few more years.

In conclusion, the GFCI 29 indicates that the state of the financial systems across the world seems to be getting better. COVID-19 has proven to be a major hurdle but many countries are recovering now that vaccines are available in lots of different parts of the world. China’s financial system is poised to become the best in all of Asia, but whether it will continue to uphold its ranking is something only time will tell.