London real estate bounces back buoyed by the anticipated conclusion of Brexit negotiations

Investors are rushing to secure property in the UK before Brexit transition ends in January. The surge in demand for homes in Britain has led to a ‘record high’ in average asking prices. The record number of sales are higher than expected with sales volume consistently high across the country.

According to the HMRC, UK residential transactions in September were 21.3% higher compared to August. Upscale London homes, in particular, are selling fast which analysts attribute to the stamp duty holiday, pent-up demand due to lockdowns, and a need for bigger space.

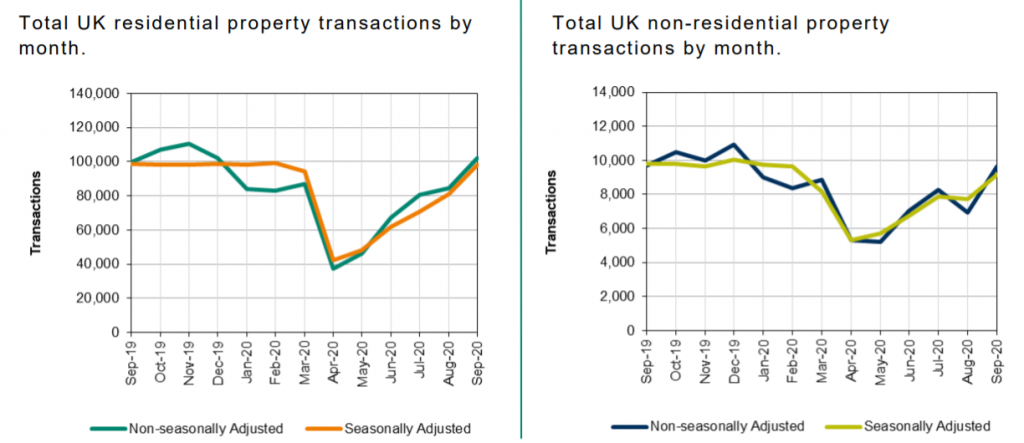

Both residential and non-residential transactions dipped in April 2020 due to the pandemic and the succeeding public health measures put in place. Fortunately, provisional transactions for property types have since grown steadily month-on-month.

Even with the spectre of Brexit, European investors are snatching up prime real estate in London due in part to the weak Stirling. Research from Knight Frank and Savills shows that investors have spent more money on £10 million-plus and £5 million-plus homes this year compared to the same period in 2019.

Chinese buyers, who account for a big chunk of property investment in London, have been taking the back seat due to the pandemic. This has allowed European buyers to overtake Asian investors. Savills reported that for the first time since 2006, domestic buyers take up the bulk of investment activity in Central London’s commercial property at 53 per cent market share.

Non-UK residents are also rushing to close deals before a 2% levy is implemented in April next year. Savills data show Europeans on top of the overseas investors list with a 17 per cent market share, followed by Asian investors (12 per cent), North American investors (10 per cent) and Middle Eastern investors (7 per cent). Similarly, Knight Frank credits French investors for 11% of all London sales followed by Hong Kong, United States and Chinese buyers in fourth place.

London homes are not the only property in high demand. With the e-commerce boom brought on by lockdowns, industrial investments and developments are expected to rise. With as much as 40% of the world’s foreign equities traded here, London has evolved as a pre-eminent business centre and a sought-after investment market for global capital.

London’s reputation as the capital of the world is also expected to be bolstered by major developments underway. There is a multi-billion world-class resort expected to open in 2024 which will further solidify London’s position as a tourism hot spot and UK’s unrivalled tourism destination.

In Savill’s European investment report, London emerged as “the most transacted office market over the last ten years.” With the market’s strong recovery in September exceeding everyone’s expectations, analysts predict strong investor interest to continue as they search for safe havens.